You may have heard this adage before when reading about active vs passive or short term vs long term investing. While I don’t believe it’s a one-size-fits-all slam dunk example, it is interesting to see how the real numbers work out over the course of 40 years. As you walk through this example, keep in mind that this is not meant to show the only good way to invest, but rather something to keep in mind as an investment philosophy while you find what works best for yourself.

Over the timeframe of 1979-2019, our example investors are going to put $200 per month towards investing in the S&P 500 index fund. This means each one will have accumulated $96,000 in saved money if they did nothing else with it. Each example investor will have a different approach, but the key is that the investors will never sell out of their investments once they put it in the market.

Investor 1

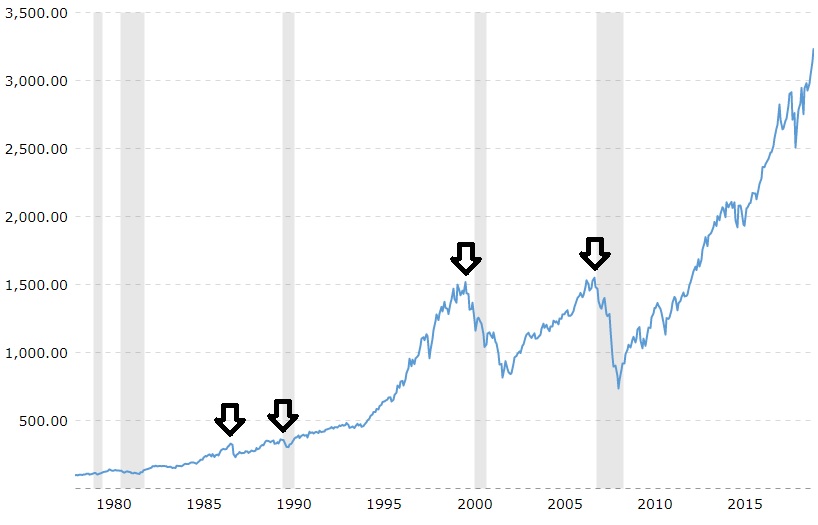

The first investor had the worst luck. This investor is going to invest their saved money in 4 lump sums at the peaks of the S&P 500 just before each major market crash. While the investor waits to put their money into the market, it sits in a bank account earning 3% interest. By 2019, investor 1 will have grown their account to $663,594. Even with the worst market timing possible, investor 1 still ended up with nearly 7x the amount of saved money.

Investor 2

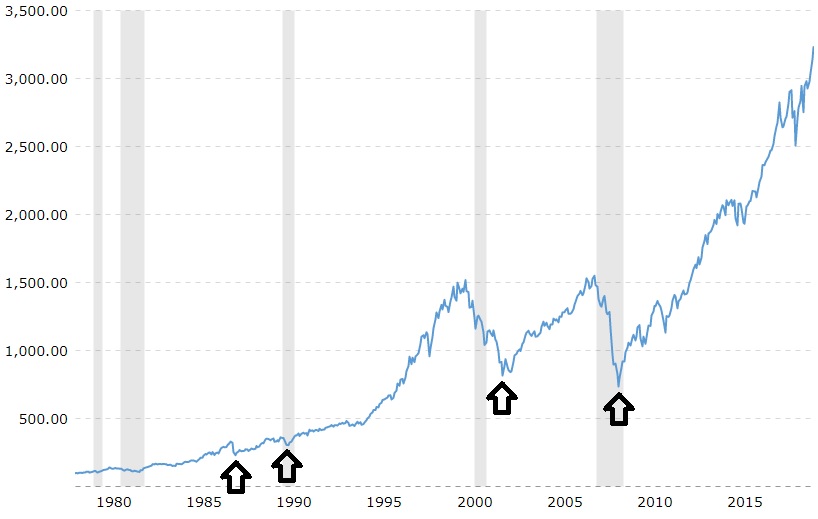

The second investor had the best luck. Acting as the opposite of investor 1, this investor is going to invest their saved money in 4 lump sums at the bottoms of each major S&P 500 crash. Again, the saved money will earn 3% interest while waiting to invest. By 2019, investor 2 has $956,838 in their account. With some fortunate timing, investor 2 ended up with about 10x their saved money, and $193,244 more than investor 1.

Investor 3

The third investor takes a different approach. There is no luck involved for this one. Rather than saving the $200 per month and waiting to invest the money, investor 3 puts it into the S&P 500 immediately each month. This allows the investor to participate in all the high growth days in between major market moves. By 2019, investor 3 has $1,386,429 in their account, which is over 14x the saved money and $429,591 more than investor 2.

| Investor 1 | Investor 2 | Investor 3 |

|---|---|---|

| Invested at peaks | Invested at bottoms | Invested often & regularly |

| $663,594 | $956,838 | $1,386,429 |